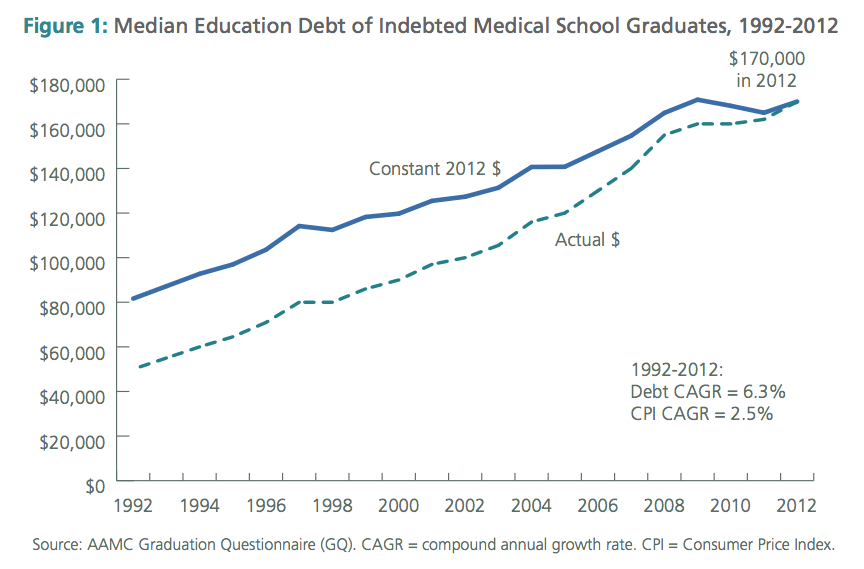

The importance of borrowing the least amount of money possible for medical school cannot be overstated. With student loan interest rates over 6% and tuition for medical school increasing every year, it is not unrealistic to estimate that you will be paying back more than two times what you initially borrowed. Unfortunately, it appears that this trend of increasing debt will continue for the foreseeable future even though physician salaries have remained flat or even decreased in recent years. The last time the AAMC published data (PDF) on medical school debt was in 2017:

To put some of this in perspective, I accumulated an average amount of debt, and when I graduated from medical school, before earning anything, my loans were already growing at a rate of over $1,000 per month! If you have not yet calculated how much debt you will have when you graduate, and how quickly interest will accumulate, you should do that now. To review all the information regarding your loans go to studentloans.gov to see the principal, interest rates, etc., and check out the repayment calculator to see how much interest you will have to pay.

Most medical schools’ financial aid office will manage getting loans for you – both to cover your tuition and to pay for other things that require money – like food, clothing, and shelter. There is nothing you can do about tuition costs, but if you are borrowing money to live off of like I did, there are a number of things you can do to try to reduce that amount.

Ways to Reduce Discretionary Spending While in Medical School

Create a budget and stick to it

No one knows your financial situation like you do, and tools like Mint can help monitor your spending and provide notifications when you are over budget. If you are using an app like Mint, one good tip is to make a budget for every major category available – not just the ones you expect charges from. Simply set the budgeted amount to $0 in categories you do not plan on spending money, like “Fees & Charges,” so if you ever get an unexpected bank or credit card fee, you will be notified immediately and can then remedy the mistake.

Find less expensive housing

Finding affordable and safe housing near campus and the hospitals may be a challenge, but do your best as this will likely be the single largest expenditure during medical school other than tuition.

Decrease total number of subscription services

You will need internet and a smartphone plan for studying and clinical rotations, but things like cable TV (get an antenna, over the air TV is free), gym membership (go outside or use your campus/hospitals’ gym), and even online video streaming membership may be unnecessary given how little time you will have for such things. Exercise is important for your health and you should continue (or start) while in medical school, but you don’t need a gym membership to stay in shape.

Reduce your mobile phone bills

A smartphone is a necessity in medical school, but traditional plans can be ridiculously expensive. I would strongly recommend switching to a no-contract provider as they tend to be cheaper. One of the best mobile phone providers I have found is a mobile virtual network operator (MVNO) called Ting. Ting states its average monthly bill is only $21 per device which is pretty consistent with my experience. Check out this review of Ting for more information and real-world comparison to T-mobile, Sprint, AT&T, and Verizon.

If you use a lot of data, Ting can get expensive. For those people, I recommend Tello as an option with less expensive data costs. Here is a great Tello Mobile review. Tello does not offer quite as many features as Ting, but is an excellent service and extremely cheap.

Eat out less

Going out to eat is convenient, but is expensive and (usually) unhealthy. During medical school you are going to be operating a pretty tight schedule, so grocery shopping and cooking meals may not be something you can do every day, but eating out every meal is not really a financially viable option either. Make sure you find a healthy balance, and when cooking for yourself, stick to the basics and plan ahead. Making a weekly schedule for your meals is a good idea. Preparing simple meals can be quick and easy.

Sell your books once you have used them

I have a list of book recommendations that everyone should buy, none of which are very expensive, but over the years the costs can add up. As soon as you take Step 1 you can go ahead and sell all those books from the first two years of medical school. Find another student who needs them or sell them online.

If you have tips for saving money as a medical student, let us know in the comments below.